FAQs

About Unlisted Shares

What are Unlisted Shares?

What is the Difference between unlisted & delisted shares?

Who sells unlisted equity shares?

Is the company involved in selling unlisted shares?

Are the shares being sold in DEMAT form?

Why do investors buy unlisted shares?

Investing in pre-IPO helps the investor:

- To participate in the growth of the company.

- Get opportunities that otherwise would ONLY be available to big entities like

PE Firms etc. - Get in at reasonable valuations.

- Diversify their investment into a newer asset class.

What is the time horizon to see the typical gains in unlisted shares?

Do the unlisted shares have any lock-in?

Depends on certain factors. As such, there are no restrictions on the sale of unlisted

shares. However, if the company comes up with an IPO and gets itself listed, then as per

SEBI rules, all unlisted shares have a lock-in period of 6 months from the date of listing.

This is 1 year prior to August 2021 if any company had filed for DRHP before then. Also,

once the company Issue date and Listing are published, typically within a few days of the

actual listing, corporate action restricts an investor from selling the stock.

What is the kind of risks involved in unlisted shares?

Below are a few risks that are constantly seen in the unlisted market, but not an

extensive list. Talk to your financial advisor for the right advice, additionally reach out to

us if we could answer any of your queries regarding the unlisted shares.

What is the kind of risks involved in unlisted shares?

Below are a few risks that are constantly seen in the unlisted market, but not an

extensive list. Talk to your financial advisor for the right advice, additionally reach out to

us if we could answer any of your queries regarding the unlisted shares.

About Unlistedkart

How do I trust Unlistedkart to do large trades?

- We are a SEBI registered Research Analyst

- We are pioneers/thought leaders in the unlisted space

- We are featured in many articles and media mentions

- We have done 250+ CR transactions

- We have tie-up with the top institutions, family offices, HNI, Ultra HNI’s

Can I know more about the company?

You can know all about us at the below link with various profiles, media mentions and our

latest initiatives. Alternately you can also reach us at [email protected]

https://linktr.ee/unlistedkart

Alternately scan the below QR code

About Buy and Sell process

(with Unlistedkart)

Does unlistedkart help clients in choosing the right stock for their portfolio?

No, our investment specialists will talk to you and help you get the right information

about a company or stock. As investment decisions are pretty much personal and mostly

depend on the unique requirements, knowledge, and risks associated with the clients,

we offer neutral research reports. Later, the clients can take the financial advisor’s

assistance to make a call on the right stock to invest in.

How can you invest in Unlisted shares?

You can go about investing in shares that are suitable for your risk profile and portfolio

by contacting us and getting research reports and seeking external financial advice. With

Unlistedkart, you can reach out to our customer specialists at [email protected] or

alternately download our app and conveniently buy and sell unlisted shares.

Will Unlistedkart help you with buying/selling unlisted shares?

Yes, we will help you with trading unlisted shares. Although we would request you to

make the investment decisions after seeking sufficient investment advice externally.

Where will you hold your shares?

Unlistedkart does not hold your unlisted holdings with itself. All your stocks are kept in

your NSDL (National Securities Depository Limited) or CDSL (Central Depository

Securities Limited) Demat account. Our platform will only present you with the

transactional information that you can find in your dashboard portfolio. All shares that

Unlistedkart deals with are already in DEMAT, and we do not have any physical shares.

Most of the shares we deal with are freely transferrable and ROFR (Right of the First

Refusal cleared/approved).

What are the documents required for procuring shares with Unlistedkart?

- An active Indian DEMAT account

- CML/CMR (Customer Master List/Customer Master Record) copy

- PAN copy

- Cancelled cheque

You can also submit these on our mobile application available in the play store and

Appstore.

I am an RM/IFA, and my clients are interested to procure Unlisted shares, will Unlistedkart Help?

We always welcome individuals/institutions that would like to democratize Unlisted

Shares as an additional asset class to help their clients with opportunities to diversify

investments. We empanel such partners through a simple empanelment process and have

multiple ways of engaging our partners. If you would like to partner with us please drop

us an email at [email protected].

Our partners are not required to reveal their client details and can procure the unlisted

shares on their portfolio and further down-sell to their clients. Alternatively, if the clients

prefer to directly work with Unlistedkart, we will continue to honor the advisor of the

clients and engage them in all transactions related to their clients.

When can we liquidate after IPO?

There is a lock-in period for 6 months once the company hits IPO. It is regulated by SEBI.

How long will it take for the shares to reflect in the DEMAT account?

Usually, it takes around 4-6 hours for the shares to reflect in the DEMAT account when the

orders are placed between Monday to Friday 9 AM to 5 PM. We will share the proof of

transfer once the shares are transferred, and typically shares show in the investor’s

DEMAT Account (statement/Transactions history) within 24 hours.

When should a client liquidate his shares?

We do not advise clients on the potential liquidity and suggest investors take external

financial advisors’ inputs. Although if there is a demand from a different investor within

our network, we help the clients liquidate shares by buying back depending on the

demand of such shares.

Do you buy back shares?

Yes, we buy back shares depending on the current demand for such shares.

What is the minimum investment?

There is no minimum investment. We at Unlistedkart have created an opportunity for all

types of buyers. Our vision is to democratize investing into growth-oriented startups at an

early stage.

About research reports

What do you mean by Unlisted shares research report?

It can be defined as a report that comprises all relevant (publicly and general) available

data and information about a firm, fund, or stock in the market that is not listed yet or

has the possibility of being on the list in the days to come. Such reports read about the

following things:

- Publicly available company information.

- Financial and annual statements.

- Directorship informs.

- Custom analysis if any.

- Other vital information to learn more about a firm and its stocks.

Are the research reports prepared by Unlistedkart chargeable?

Yes, every research report you get from Unlistedkart is chargeable. The charge is

nominal and taken as a convenience fee to assist report generation. According to the

specific and unique needs of the clients, we also prepare customized reports. Get in

touch with us here and learn more.

How will you get the research report?

Once you register for our app and complete the onboarding process, you will be able to

buy the research report online for a nominal charge. Our expert analysts will assist you

in getting to know our research reports as well as our tech platform that you can use to

raise any questions related to reports.

What if you find any issue with the research report or data on the tech platform or website? What should you do?

We, at Unlistedkart, strive to keep our website, tech, platform, and research reports up

to date with the best of our knowledge bettered by relevant sources and reports.

However, unfortunately, if you happen to come across any inaccuracy,

misrepresentation, or solicitation information in error, you should

contact [email protected].

How often does unlistedkart refresh the research report?

We refresh all the research reports available to us every quarter or as and when there is

a specific market situation that is more likely to influence the research information. Also,

we make sure to customize the reports according to the needs of our clients. And all our

reports are up-to-date and latest.

How will I know when the company will get listed?

We will only be able to provide a tentative timeline of the listing of the company based on

the public information or company disclosure.

About Taxes related to

Unlisted shares

What are the Tax Implications of Unlisted Shares?

Since unlisted shares are different from listed ones, the tax implications are different as

well.

- Short-term capital gain tax: Unlisted shares if sold within 24 months, then is

applicable on the profits and thus taxed at the marginal tax rate. - Long-term capital gain tax: Unlisted shares if sold after 24 months, then will be

applicable @20% and you get the benefit of indexation as well.

However, the profits are calculated as per FMV until the shares get listed on any formal

stock exchange. Once and if the unlisted shares you have purchased get listed on the stock

exchange and then you sold your investment, the tax implication will be as listed equity

shares only, that is long-term capital gain tax @10% on profits above Rs. 1 lakh without

the benefit of indexation or as per the govt tax indications at that

About Unlistedkart App

How to keep a track of the price change daily?

Since there is the absence of active traders like in a listed exchange there are not many price changes daily. However, to keep a track of the price change one can download the Unlistedkart app and keep a track of the same, as we make a conscious effort to validate the market prices based on the supply and demand and maintain the same on our app.

Is there an online process where one can procure or liquidate shares?

Unlistedkart app helps in procuring and liquidating shares of unlisted companies. You can

place a buy order post completion of a one-time KYC.

How do I download the app?

Play store: https://bit.ly/3DyGba8

App store: https://apple.co/3FGpL1h

Why should I buy and sell with Unlistedkart?

Unlistedkart is the most trusted and safest place to Buy & sell Unlisted shares, we offer a long list of potential high-yielding IPO shares, priced fairly, and make sure your money is safe, your shares are transferred to your DEMAT, all through an easy process. Unlistedkart brings Pre-IPO opportunities that are yet to be discovered by broader markets. With the help of the Unlistedkart app, you would be able to invest in upcoming

new-age technology companies that are focused on Agri tech, Health-tech, Fintech, Deep Tech, E-commerce, Last-mile delivery, etc. which might be a household name.

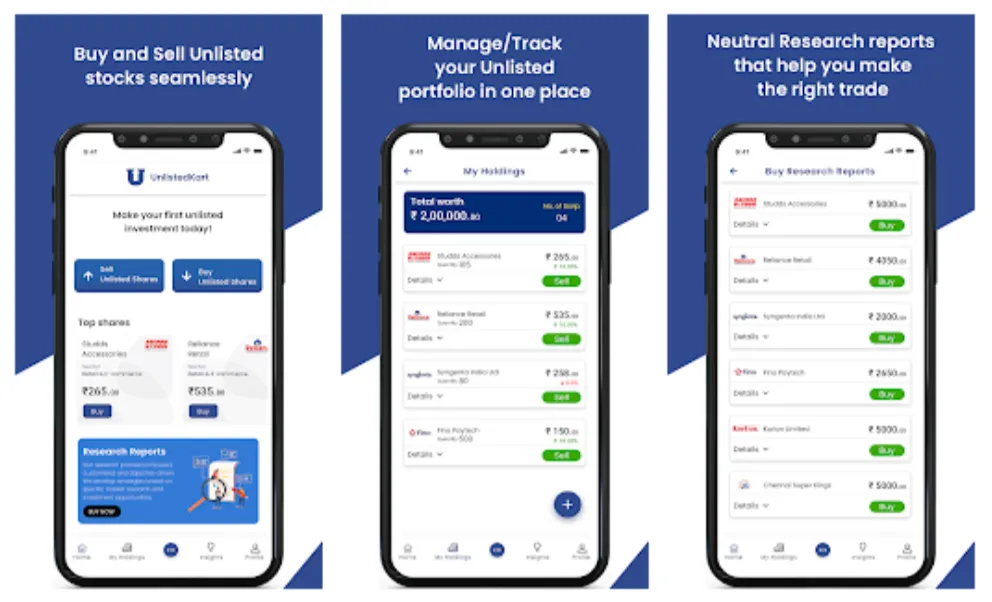

Key features of the App:

- Buy and sell unlisted stocks

- Buy Research Reports

- Access and read unlisted news/insights

- Discover the right price for your unlisted stock

- Manage/Track your unlisted stocks in one place and many more exciting features underway.

How To Get Started After Downloading the Unlistedkart App?

Signing up on Unlistedkart Android App or iOS app is very easy. Enter your mobile number and the received OTP. Just follow the steps and provide the necessary information and complete your KYC! You will have successfully signed up on the Unlistedkart app and are ready to purchase unlisted shares and reports.

How To Use the Unlistedkart App?

Unlistedkart app is very easy to use. All the services provided are mentioned on the Homepage itself. You just must click on your desired service and follow the steps. and so much more!

The Advantages of Using Unlistedkart App

Mentioned below are the advantages one can experience after downloading and using the Unlistedkart payment app.

- Quick Payments

Payments done via the Unlistedkart app are quick, seamless, and hassle-free. You can also make direct bank to bank payments with UPI post completing your KYC. - Everything At One Place

Unlistedkart app is the one-stop destination for all your unlisted financial needs.

From buying and selling unlisted shares, buying research reports, managing unlisted holdings, and accessing insights related to the Unlisted market, everything

can be done in one place in just a few clicks. - Safe And Secure

All transactions made on the Unlistedkart app are completely secure and safe. - Credit and Market risk

Be in peace once you confirm the order, shares bought are going to be transferred

to your DEMAT.